The global health and wellness market reached a value of US$3,294 billion in 2021 and is expected to reach over US$4,277 billion by 2027, exhibiting a CAGR of 4.2% from 2022-2027* – a burgeoning market for manufacturers and retailers alike.

Nowadays, wellness is no longer a luxury purchase but has become a survival imperative for consumers of all demographics. The COVID-19 pandemic refocused human behaviour and shopper intent towards health and wellness products like no event in the history of consumerism.

A feature of the 2020 pandemic and its consequences on consumer and shopper behaviour is the focus on preventing health issues instead of a traditional pathology approach. Health retailers are now expected to service broader demand for an array of products that harmonise and support healthier lifestyles, instead of an overreliance on dispensing cures for ailments.

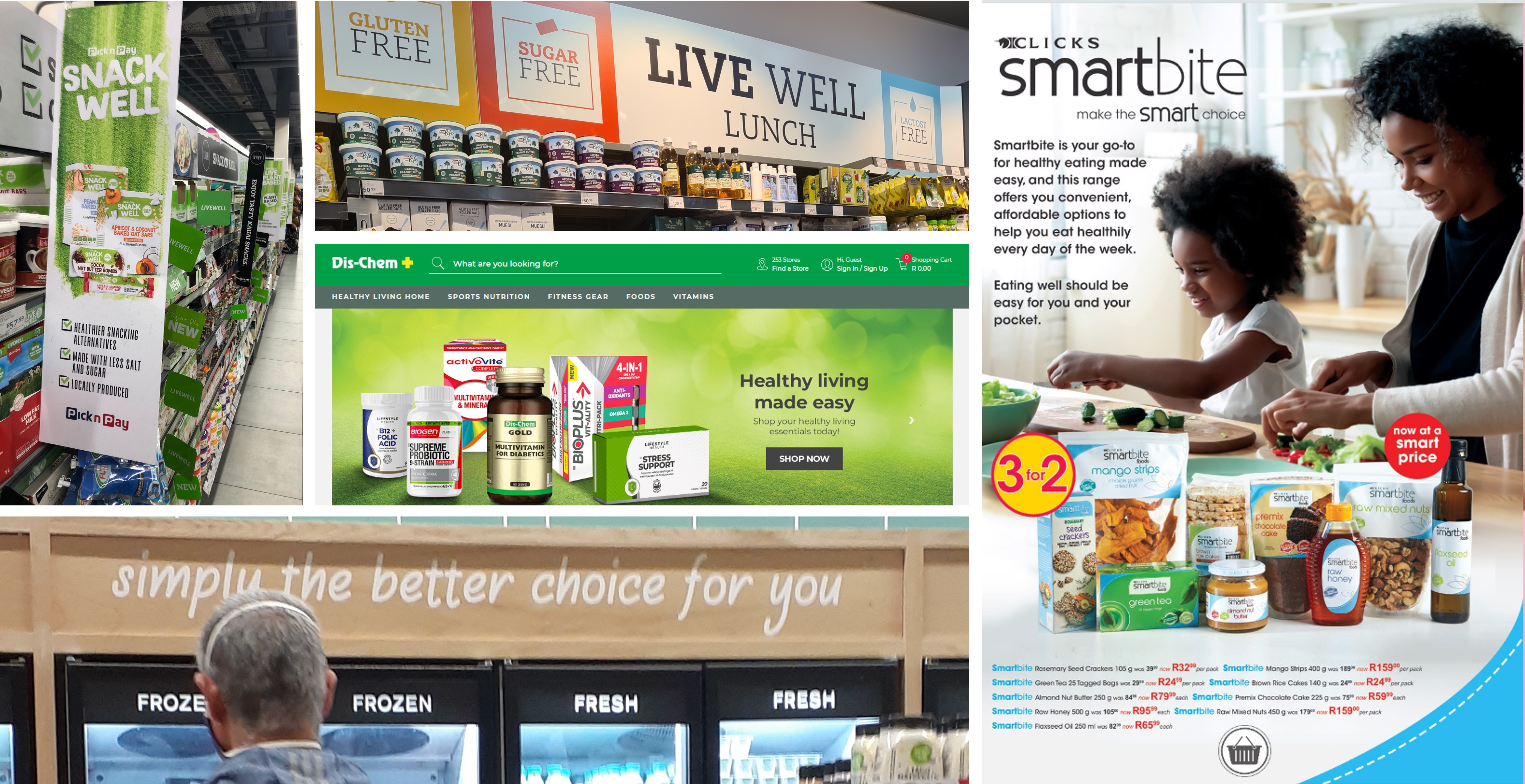

Retailers are mirroring consumer changes, and in the wellness market that means mastering an evolving set of expectations. Perfectly positioned to leverage consumer desire for personalisation and shopper engagement, the wellness, personal care and health categories are deeply ‘personal’. And, as such, they present a unique opportunity for dialogue, advice, recommendations and specific product recommendations across all retailer platforms.

The South African wellness, health and personal care market is unsurprisingly aligned with the global move towards sustained wellness practices. Even within a constrained trading environment – where raw material sourcing is under pressure and CPI is at its highest since the drought of 2016 – the personal care, health care and beauty  category saw growth of +11.4% YoY, of which personal care contributes R31 billion, while the health care category contributes R13 billion, derived from self-medication/OTC (R9.8 billion) and vitamins and minerals (R3.2 billion).

category saw growth of +11.4% YoY, of which personal care contributes R31 billion, while the health care category contributes R13 billion, derived from self-medication/OTC (R9.8 billion) and vitamins and minerals (R3.2 billion).

Quantifying wellness in 2022 remains a tough task. One consumer’s food supplement is another’s food source, be it gluten free, milk substitutes, daily multi-vitamins and/or smoothie superfoods. The evidence for increasing consumer demand for previously specialised wellness products is seen in increasing shelf space (gluten and dairy free products available at most major retailers), value offerings (bulk packs of seeds and nuts), and own-brand wellness offerings (Checkers’ Simple Truth range and others).

*Source: Research and Markets

Discover how to optimise opportunities in an omnichannel health and wellness market

Global trends, challenges and opportunities in the health, wellness and personal care market influence domestic retailers. Trade Intelligence explores and maps the seismic market shifts in consumer and shopper trends in the comprehensive 2022 edition of its Health, Wellness and Personal Care Report.

Focussing on the interplay and synergies between digital and physical retail, the Health, Wellness and Personal Care Report brings global trends into context using local examples, as well as providing a playbook for strategists at all management levels operating in health, wellness and personal care retail.

For more information or to order the report, click here or contact Shelley van Heerden on shelley@tradeintelligence.co.za or +27 [0] 31 303 2803.

About Trade Intelligence

Trade Intelligence is South Africa’s leading source of consumer goods retail research, insights and capability-building solutions, focusing on the industry’s corporate and independent retailers and wholesalers. We are the trusted voice of the sectors in which we operate, aggregating information to amplify knowledge, grow capability, and enable collaboration that drives profitable trading relationships and sustainable sector growth.