Africa has been identified as the 21st century’s great frontier for business growth. African retailers and brands need to innovate and operate from a position of knowledge if they are to benefit from the opportunities this brings.

Africa is open for business. The continent has a rapidly growing and urbanising population, an increasingly sophisticated financial and monetary system, improving infrastructure, and is adopting information and mobile technology at a rate that is the envy of other regions. All of this, coupled with an ongoing interest in the continent from global investors, has led to growing demand for goods and services – including FMCG retail.

Grocery retail in Africa has traditionally been dominated by independent and informal business, from small supermarkets and the wholesalers that serve them, to street traders. And while modern retail is advancing on the continent – established in South Africa and with economies like Zambia, Kenya, Egypt and Morocco beginning to formalise – African consumers still buy over 70% of their food, beverages, and personal care products from around 2.5 million small, independent shops.1 Outside of South Africa, industry sources estimate that informal channels on the continent account for between 40% and 90% of total food sales, depending on the country.2 What is changing, however, is the sophistication of these small businesses.

Several factors are driving this change. Shop owners are generally more educated and digitally literate than the general population.3 They are also increasingly younger, more adaptable, and inclined to respond by changing their businesses to the challenges and opportunities presented by a shifting economic landscape. Finally, their widespread adoption of technology enables them to take advantage of a new IT and mobile ecosystem for payments, ordering, and supply chain efficiency.4

1 https://www.bcg.com/publications/2022/the-future-of-traditional-retail-in-africa

2 https://smollan.com/the-new-informal/

3 https://www.bcg.com/publications/2022/the-future-of-traditional-retail-in-africa

4 https://www.howwemadeitinafrica.com/the-future-of-traditional-retail-in-africa/146539/

Africa is itself becoming a friendlier environment for the modernisation of retail. The growing economic cohesion of the continent is creating a more welcoming environment for cross-border business and eliminating some of the advantages historically enjoyed by brands and businesses from beyond our shores. The African Continental Free Trade Area (AfCFTA), established in 2018, now has 44 member countries, which have agreed to create a single, liberalised market; reduce barriers to capital and labour; develop regional infrastructure; and establish a continental customs union.

In addition, the continent’s expanding digital infrastructure has allowed many businesses to reach their customer base in different ways. Point of sale technology facilitates payments and provides shopper data; mobile technology drives efficiencies in purchasing and increases sales; and rising internet penetration enables greater adoption of enabling technologies. Social media platforms like WhatsApp are increasingly being repurposed by entrepreneurs as business platforms; and in partnership with brands and distributors, small retailers are able to access shopper data made possible by Fourth Industrial Revolution (4IR) technology advancements like artificial intelligence. These businesses are also expanding beyond retail: increasingly, for example, informal retailers serve as distribution points for essential financial services such as payments and remittances, driven by a recent proliferation in products and services aimed at this market.

Among the big supermarket chains, the continent is increasingly contested space. While South African retailers have enjoyed limited and inconsistent success on the continent, they have established a toehold in some key geographies. Shoprite now operates in 14 countries outside of South Africa, and Pick n Pay has enjoyed its own successes. International retailers are picking up some markets, with the likes of Casino, Carrefour, and Système U operating in Francophone West Africa. Carrefour is also developing a strong footprint in East Africa, particularly Kenya and Uganda. In Kenya, local retailer Naivas (with 90 stores) has outlasted challenges from a number of South African and local competitors.

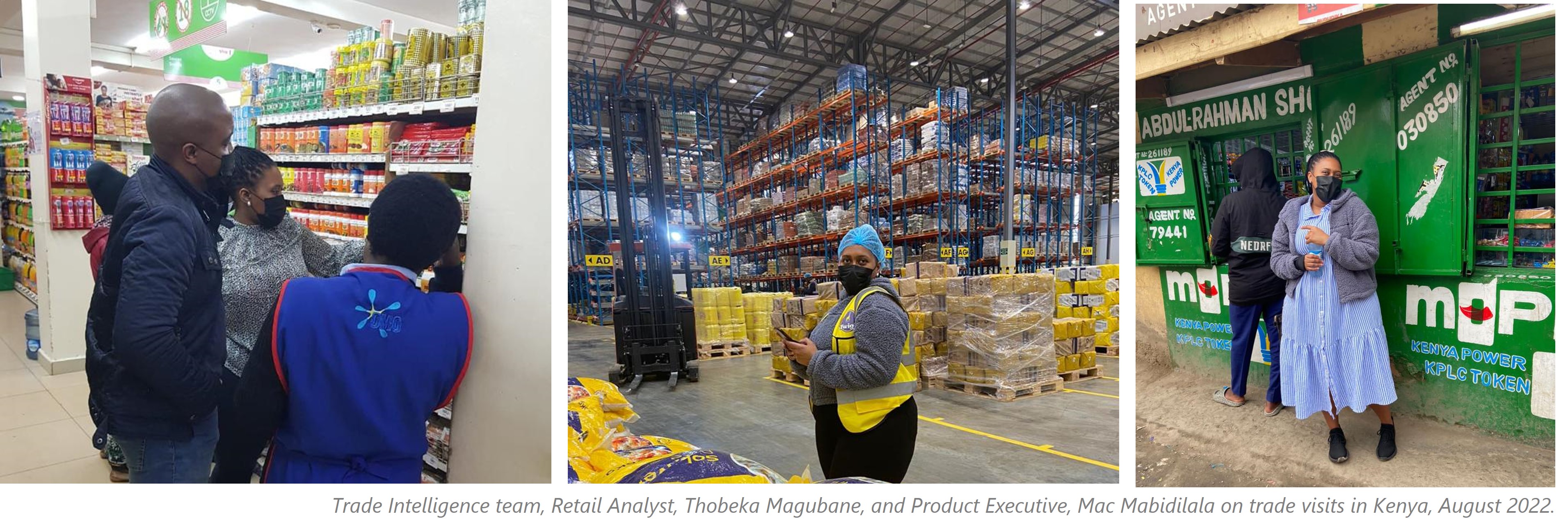

Of course, the continent remains a challenging place to do business. Splintered supply chains, areas where improving digital and physical infrastructure has not yet reached, conflict and poverty, and a sometimes difficult regulatory environment – all of these remain realities for businesses expanding their footprint in Africa. But while conditions remain particularly difficult for formal retail players, the continent is more hospitable for brands. “As African economies mature, routes to market are expanding,” explains Trade Intelligence Retail Analyst Thobeka Magubane. “South African brands need to take advantage of these opportunities. But they need to operate from a position of knowledge, be open to innovation, and explore local partnerships.”

Brands should also explore opportunities closer to home before testing the more competitive markets of East and West Africa and beyond. “SADC countries like Namibia, Botswana, and Mozambique show significant potential for growth,” says Magubane. “They’re also easier to reach using South African distribution and logistics infrastructure, whether it’s extensive road networks, in-country partners, or the big wholesalers and cash and carries set up close to national borders.”

Earlier this year, a team from Trade Intelligence visited Kenya, partnering with local businesses to research the retail sector, both formal and informal. One of the outcomes of the trip is a flagship ‘Retail in Africa’ report, to be published later this year. Given the complexities of retail on our continent, as well as the opportunities it represents, the report will be a valuable toolbox for any business wishing to play successfully in this vast and increasingly sophisticated market.

Click here for more information on the Trade Intelligence Retail in Africa Report.

About Trade Intelligence

Trade Intelligence is South Africa’s leading source of consumer goods retail research, insights and capability-building solutions, focusing on the industry’s corporate and independent retailers and wholesalers. We are the trusted voice of the sectors in which we operate, aggregating information to amplify knowledge, grow capability, and enable collaboration that drives profitable trading relationships and sustainable sector growth.