South Africans are pretty excited about Black Friday this year, but in a sobering way.

Trade Intelligence partnered with Chirp to run an online survey to find out what South Africans are planning around Black Friday and over 600 people volunteered their views.

Some local media are already reporting on subdued expectations of what has been termed ‘Bleak Friday’ and we can partly confirm that.

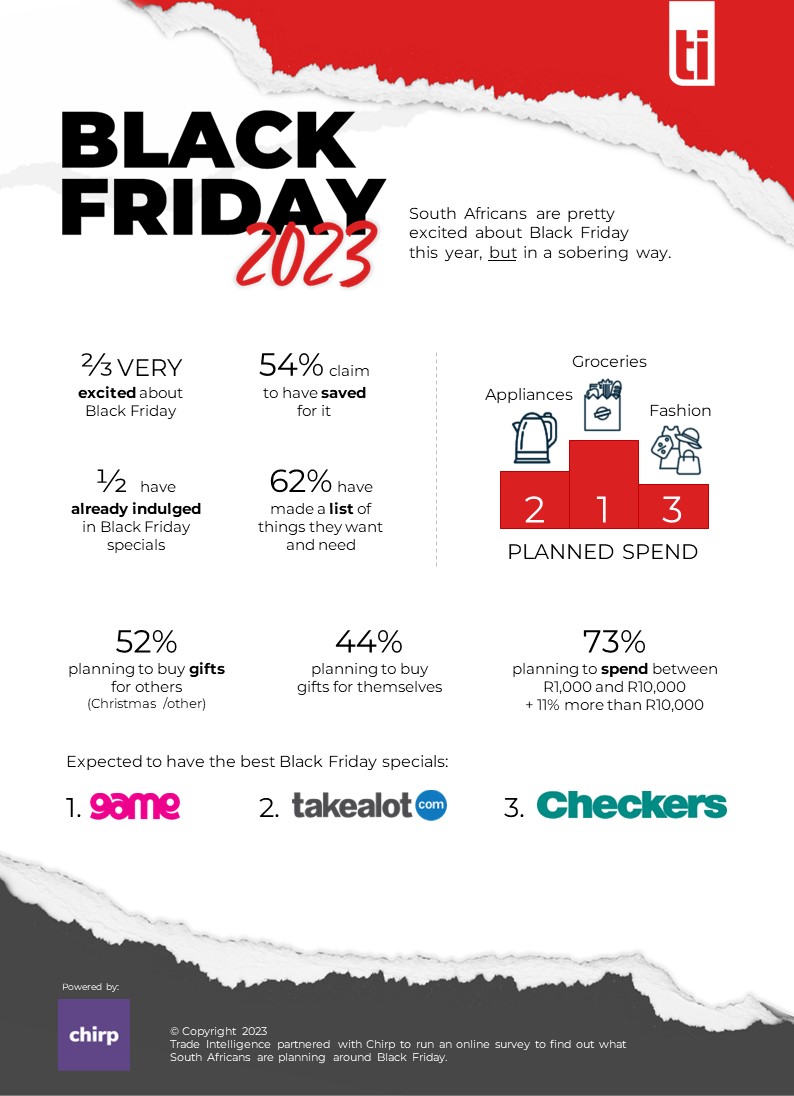

On the one hand, South Africans planning to engage with Black Friday in some way are excited – nearly two out of three say they are five-out-of-five excited for Black Friday. On the yawn to yippee! scale, that’s a solid yippee!

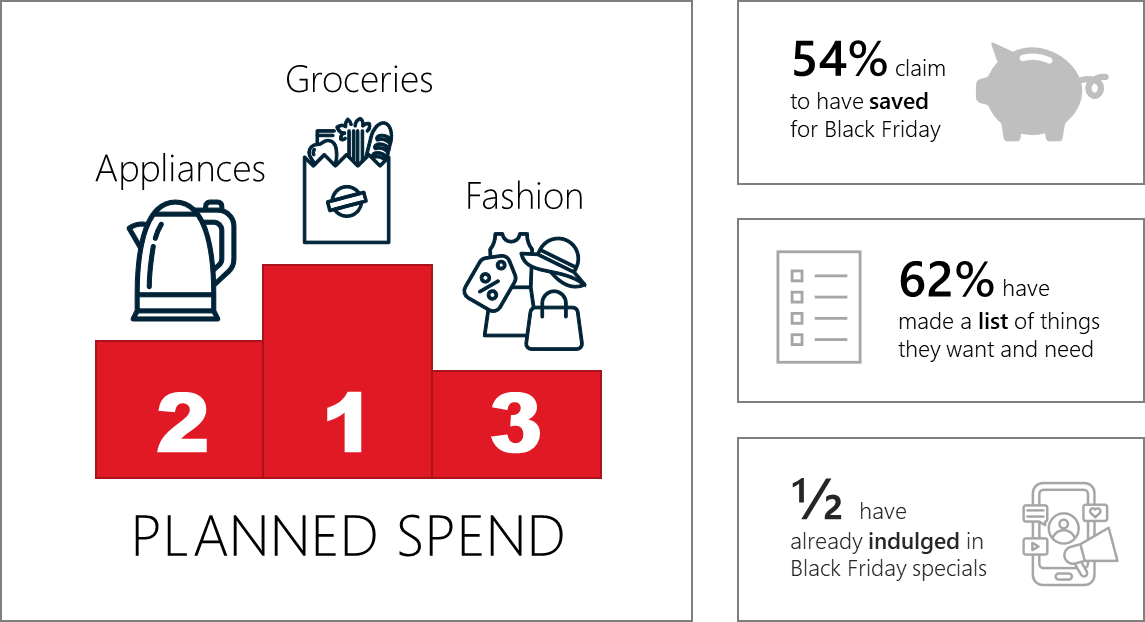

BUT while ‘gifts for myself’ was the third most-often mentioned type of planned purchase, household basics like groceries and other necessities occupied the top two spots. So Black Friday is not being seen as an excuse to indulge oneself, but rather as a way to stretch the beleaguered household grocery budget.

Sadly for the excited grocery shoppers, though, they’re not really expecting the grocery retailers to come to the party in terms of Black Friday specials. When we asked people to choose which retailers they expected to have the best Black Friday deals, only one supermarket made the top 6.

There are high expectations of Massmart, with Game and Makro taking the #1 and #4 spots on this list respectively. Takealot represents the online retailers at #2. Checkers is the sole supermarket at #3 and Clicks and Mr Price round out the top 6.

A whopping 54% of our respondents said they’ve set money aside to spend on Black Friday deals. We didn’t demand to see their piggy banks, so we confess that we’re a little skeptical about this claim. But if shoppers spend what they say they plan to spend, our battered economy can expect a healthy boost, with 30% planning to spend between R5,000 and R10,000, and a further 11% planning to spend more than R10,000.

The spenders over-represented in the R5,000+ category are men, 18- to 24-year-olds, and middle-income households (those earning between R10,000 and R30,000).

These big spenders are:

- Particularly excited about Black Friday (84% are five-out-of-five-yippee! excited)

- More likely than lower spenders to have saved up for Black Friday

- Already shopping Black Friday deals

- More likely than lower spenders to be planning to shop Black Friday grocery deals

So, it seems the winning retail strategy will be to attract the big spenders and get them to concentrate their spend in one place, rather than trying to get a few ZAR out of thousands of shoppers’ wallets.

Whatever their strategies, we wish retailers and bargain-hunters well over this crazy time.

Watch this space for our follow-up post-Black Friday research when we report on what actually got spent and on what.

Download the Black Friday infographic here.

If you are interested in bespoke research in FMCG retail for your business, reach out to shelley@tradeintelligence.co.za.

About Trade Intelligence

Trade Intelligence is South Africa’s leading source of consumer goods retail research, insights and capability-building solutions, focusing on the industry’s corporate and independent retailers and wholesalers. We are the trusted voice of the sectors in which we operate, aggregating information to amplify knowledge, grow capability, and enable collaboration that drives profitable trading relationships and sustainable sector growth.

About Chirp

Chirp is an all-in-one research platform. Chirp lets you survey highly specific target groups and gather consumer opinions in minutes. It allows you to easily create custom questionnaires using the built-in form builder with various survey question types, logic jumps and other advanced features. Consumers are instantly recruited for the survey that matches the clients target market demographics and interests with the Chirp advanced audience builder. Push notifications are sent to consumers in the panel and can respond instantly. Responses can be reviewed in minutes with the real-time analytics dashboard and insights, allowing results to be shared and exported.

Get in touch with Chirp by contacting Nick Wallander at nick@getchirp.co and visit www.getchirp.co or download the app by following this link, https://linktr.ee/getchirp or alternatively snapping the QR code