THIS ISSUE: 19 Jul - 25 Jul

A slow news week in this great industry we call home. An interesting acquisition by Dis-Chem though, cryptic hints from Makro about its mini-Makro (Mikro?) initiative, PepsiCo bets big on a small, small fruit, and some of the world’s biggest FMCG manufacturers ask authorities worldwide for more, not less, environmental regulation. Enjoy the read.

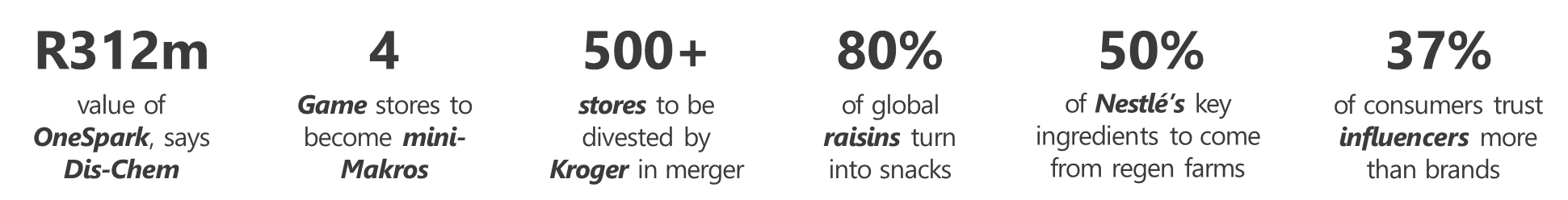

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Dis-Chem Vertically challenged

Vertical integration, according to the Worthies at Oxford, is “the combination in one firm of two or more stages of production normally operated by separate firms.” It’s the Holy Grail for businesses with the ambition of owning everything in sight, and often falls afoul of the Competition Authorities – recently, you will recall, Clicks was disallowed from owning drug manufacturer Unicorn, which supplied the retailer with certain generic medications. Rival Dis-Chem is proving something of a master of vertical integration, particularly in the area of financial products linked to its core business. Last week, PwC, appointed by Dis-Chem to evaluate the fairness for shareholders of its 50% acquisition of life insurance provider OneSpark, announced that it was indeed kosher, an opinion that has been reviewed and approved by the JSE. There is some concern that at R312m Dis-Chem has overvalued the business, in which Dis-Chem CEO Ivan Saltzman and his son Saul Saltzman are large shareholders.

Comment: One assumes that Dis-Chem sees the downstream value in the transaction.

-

-

Woolworths And how does that make you feel…?

DataEQ, which takes a unique approach to structuring social media data through the synergy of AI and human intelligence, has released its latest South African Retail Sentiment Index, showcasing consumer perceptions of the nation’s top grocery retailers as expressed on social media. Bottom line: Woolies wins. The caveat is that of all retailers whose mentions were surveyed – Checkers, Pick n Pay, Shoprite, SPAR, and Woolworths – the Dapper One saw the smallest improvement and declined in the pricing category to third behind Shoprite and Checkers. Retailer house brands got a big nod from punters, but perceptions declined for all in customer service. The good news, industry-wise, is that the ‘Net Sentiment’ for the sector was up 5 points, driven by improvements across all of them. Net Sentiment is a real-time customer satisfaction metric that is measured by collecting unstructured text from publicly available online conversations.

Comment: Checkers may step up to the plate. Other retailers may offer better value. But Woolworths remains the gold standard of a larney place to shop.

-

-

Smollan A finger on the (quickening) pulse

A quick look at the major trends shaping shopper behaviour as we hit and then rapidly pass the mid-year mark, from our friends and colleagues at Smollan.

Sustainability: Customers want organisations to step up and show proof of their eco stance – although they do have “green fatigue” and can quickly spot businesses that are simply ‘greenwashing’ their operations.

AI: A rapidly evolving technology that retailers may use to improve efficiencies and processes while maintaining a human touch.

,strong>Personalised communication: Consumers want messages tailored to them and their purchasing behaviour rather than more general marketing messages. Empathy comes more dramatically into play than it perhaps ever has.

Social commerce: 37% of consumers trust influencers more than brands, which are now more focused on telling stories on social platforms that conclude with a commerce moment.Comment: Solid stuff from a company that knows retail like the back of its hand. We do indeed live in times when a mid-year trend review is increasingly essential. For more on these trends, view the full article here.

-

-

In Brief Game on

How’s that Game/mini-Makro switcheroo going, you ask? For the uninitiated, Massmart will shortly be trialling the conversion of four Game stores to small-format Makros. “We have been delighted by strong expressions of support from landlords, suppliers, consumers, and our own staff,’ says group corporate affairs head Brian Leroni. Question is, what will these stores be? A convenient place to buy office equipment and fridges? Or Massmart’s next effort to enter the FMCG mainstream? Moving on, nice work from Pick n Pay which is refurbing aircon systems with energy-efficient technology rather than replacing them. To date, 14 stores have had their AHU refurbished, with another 17 in the pipeline. Pick n Pay has set a target to be net zero carbon by 2050 and is in the process of setting credible emission reduction targets through its Science Based Targets Initiative.

Comment: Makro is a brand with enormous heritage, and the jewel in the Massmart crown. Depending on the shape these new stores take, there could be a change coming down in mall-based retail.

-

-

International Retailers Super-novela

This is turning into a soap opera ‘will-they-won’t-they’ plotline spanning actual seasons. The prospect of a merger between US grocery behemoths Albertsons and Kroger was first floated in 2022; by the time it actually happens, Kamala will be picking out second-term curtains for the Oval Office. What gives? In March, the Federal Trade Commission (FTC) sued to prevent the merger, on the grounds that it would be anti-competitive. As part of the deal, Kroger will be divesting itself of over 500 stores, DCs and manufacturing plants to a third party, C&S Wholesale Grocers. This has provoked a wave of lawsuits from communities which believe that the divestment will leave them with subpar stores managed poorly by a wholesaler. All of this in an environment where grocery stores in rural and low-income urban locations are being replaced by dollar and convenience stores that offer little in the way of actual nutrition and lead to the expansion of food deserts.

Comment: On this ill-starred merger, the jury is quite literally still out.

MANUFACTURERS AND SERVICE PROVIDERS

-

PepsiCo Raisin the bar

Consider the humble raisin. Small, unattractive, and in the right hands, highly lucrative. Hands, you will be surprised to know, like those of PepsiCo South Africa, which when it bought out Pioneer Foods inherited a platform for the growth of its snacking business, in which raisins play a not-insubstantial part. 80% of raisins globally find their way into the snacking value chain, and this share is likely to grow as people seek healthier ways to consume those small in-between meals, or that sustaining mouthful at the top of a strenuous but scenic slope. PepsiCo is currently the largest raisin packer in South Africa, buying around 40% of our production, but has ambitions to up its share to 50% in the next five years. We did not know this (but clearly someone at PepsiCo does), South Africa yields around 6% of global production at 85,000 tons of raisins per year, but that is likely to hit 100,000 tons next year thanks to better-yielding cultivars.

Comment: You do the numbers. Raisins are going to be big. Perhaps PepsiCo shouldn’t be the only one cramming them into its snacks.

-

-

Biodiversity Nature calls

130 businesses, including Unilever, Danone and Nestlé, have called for global leaders to implement robust sustainability policies, under the umbrella of Business for Nature, a global coalition that brings together businesses and conservation organisations in service of our embattled planet. The businesses are all signatories of an open letter that includes a Biodiversity Plan that calls for the implementation of global regulations on businesses like theirs, on the very reasonable understanding that they will not act at sufficient scale unless compelled to do so. This is not to say that any of them won’t at least try: Unilever, for example, has committed itself to sustainable practices and has been a vocal advocate for stronger environmental policies like working alongside smallholders to improve the sourcing of palm oil. Nestlé has committed to sourcing 50% of its key ingredients from farmers practising regenerative agriculture by 2030, and Danone has been actively involved in promoting sustainable agriculture and reducing its environmental footprint.

Comment: Responsible businesses, indeed, that call for regulation of their own practices.

TRADE ENVIRONMENT

-

VAT Taxing times

Big news for VAT during President Ramaphosa’s address at the opening of parliament last week. Looking for ways to reduce the cost of living for strapped South Africans, the Government will soon be launching a review of administered prices, including the fuel price, and will expand the range of essential food items exempt from VAT. The current list includes such staples as brown bread, dried beans, pilchards, dairy powder blend, fruit, vegetables, vegetable oil, and milk. No hint has been given on what else might join the list, but the expansion has been opposed by the National Treasury, which argues that it would result in a revenue loss for the Government while providing little additional benefit to poorer households. “Targeted cash transfer to the poor is better and more redistributive as opposed to VAT, which benefits mostly high-income households,” says Deputy Minister David Masondo.

Comment: Robust debate in a healthy democracy about what works and what doesn’t.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“What happens to a dream deferred? Does it dry up Like a raisin in the sun? Or does it explode?”

1.png)