THIS ISSUE: 12 Jul - 18 Jul

A mid-year review, of sorts, from StatsSA, with various numbers – some bad, of course, but there are bright spots too. Good work from SPAR2U, a closer look at the Pick n Pay rights offer and what it tells us about the business, and retailers in Cape Town get behind flood relief efforts. Enjoy the read.

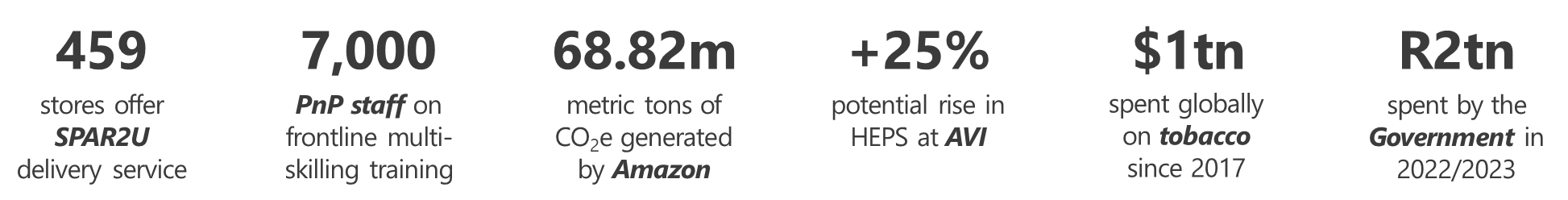

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

SPAR Braaivleis, Rugby, Sunny Skies and Motorbikes

Big Boy motorbikes are fast becoming as ubiquitous as hadedas and minibus taxis. And they reflect not just a change in the way we shop, but a whole new economic reality for tens of thousands of South African families. Doing its bit to boost this new economic sector, while getting its own products and services into the hands of South African families, is SPAR, which outsources some township deliveries for its SPAR2U to businesses like Delivery KA Speed SA and KasiD, which offer local knowledge and access with a side-order of economic progress for the communities where they operate, which so far include Kempton Park, Kaalfontein, Ivory Park, Mamelodi, Glen Marais and Hammanskraal. “The success of Delivery KA Speed and KasiD in townships underscores the transformative potential of community-focused initiatives enabled through partnerships such as these with SPAR2U,” says SPAR’s PR, Communications and Sponsorships Manager Mpudi Maubane. SPAR2U, a late arrival on the home delivery scene, offers delivery from 459 stores around the Beloved Country, with more surely to follow.

Comment: A very South African solution to a range of local challenges. Nice work. For more on these dynamic businesses and others shaping our informal trading landscape, take a look at the latest release of our Informal Retail Channel report here.

-

-

Pick n Pay Know your rights

Mysterious markets savant The Finance Ghost has dug around in Pick n Pay’s long-awaited rights offer circular letter and emerged with some insights over what the offer will mean for the business. For starters he – or indeed she, or they – point out that a fair old chunk of the R4bn Pick n Pay are looking to raise will go towards financing day-to-day operations, not just reducing debt or implementing the turnaround strategy. The document also reveals that the business will be divided into six operational divisions rather than the existing three, which gels with Sean Summers’ desire that his senior managers get out into the stores more. The Ghost also notes that Pick n Pay has placed 7,000 employees on a “frontline multi-skilling programme”, which will no doubt go some way to answer perennial shopper concerns about service. He also draws attention to the fact that Pick n Pay notes that franchise stores achieve a better trading density than corporate stores – and thus sees more franchises as the solution rather than better trading densities all round.

Comment: Illuminating stuff. The real proof of the rights issue’s impact will be in the bottom line a year or so from now.

-

-

In Brief Halfway mark

There is now, apparently, something called ‘Halfway Day’, which is the cause for sales and promotions, as these occasions generally are. At Massmart brands Game, Makro and Builders, the holiday saw punters stocking up on household and pantry essentials. In the case of Makro, this meant chocolate bars, charcoal briquettes, toilet paper and long-life milk. “This year’s Halfway Day sale showed us that our customers have one thing in common – they prioritise their families and their homes above all,” observes VP of Group Marketing Katherine Madley. To the Western Cape, next, where various businesses are rallying around relief efforts for victims of last week’s flooding and high winds. Through Gift of the Givers, Engen has handed out essential supplies, including food hampers and hygiene packs and Pick n Pay has opened all its stores across the region as donation drop-off points. Finally, Shoprite, Mobile Soup Kitchens have been serving warm meals at the rate of 6,000 a day to the people of Khayelitsha, Philippi, Strand and Sir Lowry’s Pass Village.

Comment: As weather disasters become more extreme and unpredictable, corporate citizens will have an even greater role to play in relief efforts.

-

-

International Retailers Life’s a gas

3% is a lot, if applied to something almost incomprehensibly large, like Amazon’s total emissions for 2023. And that is the amount they fell by: over two million tons, to 68.82 million metric tons of carbon dioxide equivalent. In 2019, the online retail behemoth set a target to meet 100% of its electricity consumption with renewable power by 2030; it has met that target with six years to spare. Now it’s going after emissions, with the goal of reaching net zero carbon by 2040. Digging a little deeper though, there’s a more nuanced picture: Amazon’s total emissions take into account its supply chain, third-party logistics and purchased electricity; emissions from its own direct operations (including data centres) rose +7% to 14.27 million tons as the number of packages delivered skyrocketed. Amazon is the world’s largest buyer of renewable electricity and invested in 112 new renewable projects of its own last year.

Comment: With the inexorable rise of AI, processing power is becoming a problem. One that is perhaps beyond the power of ChatGPT to solve.

MANUFACTURERS AND SERVICE PROVIDERS

-

AVI Heads up

A trading update from Anglovaal Industries Limited, a name we prefer to think of pronounced in the plummy tones of someone on his second brandy after dinner at the Illovo Club, circa 1972 …. where were we? Ah yes. It’s all sounding quite positive: the business reports that revenue grew +6.3% to R15.86bn in the full year through June, on the back of selling price increases to offset cost pressures and volume growth in the beverage categories. The Entyce beverages business, in particular, saw strong growth with creamer doing particularly well, gaining market share and benefiting from additional production efficiencies. Snackworx? Not so much, with volumes declining in the second half, and I&J also had a rough go of it in the face of increased competition and reduced demand for abalone. All this taken into consideration, says AVI, it anticipates that consolidated headline earnings per share, a vague but popular indicator of profitability, were expected to increase 21-25%.

Comment: In this tricky economy, a degree of diversification is a useful hedge.

-

-

In Brief Where there’s smoke…

Nampa, on whom we reported last week, has already disposed of its Nigerian assets to start digging itself out of its R5bn debt hole. Now, apparently, it’s also looking at disposing of its Angolan and Zimbabwean operations – although it has not reached a final decision on whether to go that route. Moving on, Tongaat Hulett has obtained approval from its creditors to enter into a deal with the Vision consortium, that would see it selling existing shares and creating new shares in exchange for R8.5bn worth of Tongaat debt. Now the troubled sugar giant has to get the nod from the shareholders. Should it achieve this, it could be back on the JSE as soon as early 2025. Finally, have a guess at what people globally have spent on tobacco products since 2017. Neergh! Incorrect. It is in fact $1tn dollars – or more than the GDP of Switzerland. 1.3 billion people globally use the soothing weed, a number the tobacco industry will ensure does not drop too far, through innovative delivery platforms and aggressive marketing to certain key demographics.

Comment: People eh? What are you going to do?

TRADE ENVIRONMENT

-

Economy Numero uno

The bearded – and by now probably haggard – sages over at StatsSA have had a heck of a month and have helpfully produced a summary of everything they’ve measured, triangulated, estimated, and calculated these past thirty-odd days. First up, a -0.1% Q1 decline in GDP, with the haul dragged southward by tardiness in the manufacturing, mining and construction sectors. Agricultural activity rose sharply on the back of stronger horticultural production. Next: employment. StatsSA reports that a net 67,000 jobs were lost in the formal non-agricultural sector in Q1, with the big losses in the trade and community services industries. There were gains in manufacturing, transport and construction, though. Q2, they say, is off to a better start in general terms, with several sectors, including our own, posting month-on-month and year-on-year revenue increases. Finally, the government spending numbers are in for 2022/23, during which period the government disbursed R2tn, and generated or received R1.7tn in revenue, with taxes accounting for 97% of that.

Comment: StatsSA has received some flack lately, particularly regarding the employment numbers. But it’s an office that does sterling work – much of which has found its way into these pages over the years.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“When men are employed they are best contented.”

1.png)