THIS ISSUE: 07 Jun - 13 Jun

An economic update from the Trade intelligence team down below, with the numbers pretty much as you knew they’d be. No update as yet from Luthuli House though, where we assume some pretty significant decisions are being taken – or kicked down a potholed road for another day. We hope, like retail trade sales for March, that they might surprise us on the upside. Enjoy the read.

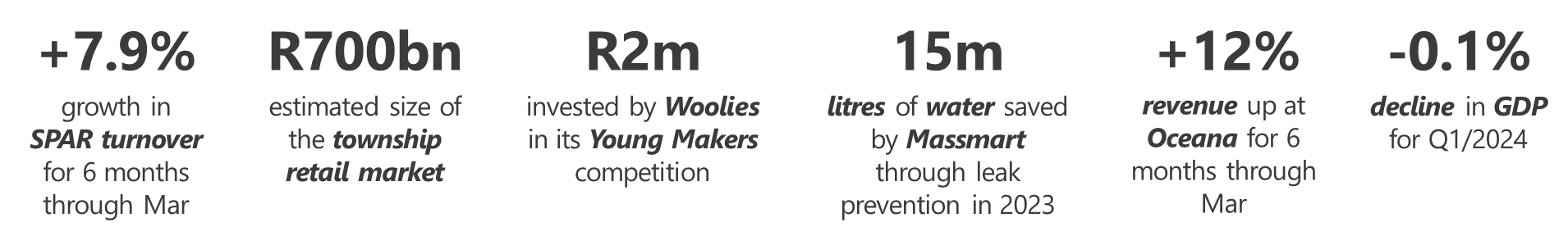

YOUR NUMBERS THIS WEEK

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

SPAR Green shoots?

Leading in with those interims from SPAR: turnover from continuing operations – including Southern Africa, Ireland, South West England and Switzerland – was up +7.9% to R77.2bn for the six months through March, but operating profit was up just slightly to R1.6bn, and profit after tax fell -10% to R870m. On the upside, the Group reported that it should be shot of its Poland operation sometime in September – a venture which represents a major operating loss for SPAR, including a R721m write-down of assets. SPAR Southern Africa reported a total increase in wholesale turnover of +4.8% for all business units, and private brand sales increased +7.6%. TOPS grew sales +12.8%, and online sales positively exploded, with SPAR2U available in 420 sites at the end of the reporting period. Turnover at its BWG business in the British Isles grew +5.7% in Euro terms. Switzerland was -4.6% in CHF, but the Group did mention that it had maintained market share in that scenic geography. No dividends though.

Comment: SPAR’s recovery may be forthcoming, but the business has a long way still to go. For more on those results, have a look at our summary here.

-

-

Shoprite Banking on it

“Shoprite has been the standout performer among the food retailers as the Group continues to flawlessly execute on its clearly defined strategy and gain market share.” This from none other than Nedbank, which has commended the Big Red One on its early investment in growing market share in SA’s township economy, estimated at a very cool R700bn. Nedbank speaks approvingly of Shoprite’s rigid and disciplined brand-segmentation strategy and is particularly complementary of the Usave eKasi container-store format. The approach is paying off, as anyone with half an interest in retail could tell you: the Group opened 197 stores across its retail brands in the six months through December 2023 and has gained market share for a grinding and seemingly unstoppable 58 months. “In our house view equity model, we hold our retail exposure via Mr. Price and Shoprite, where we are overweight relative to our benchmark,” says Nedbank, using English words.

Comment: What they’re saying is, Shoprite is a large, firm mattress under which they are happy to store their cash. And yes, the township strategy, launched so many years ago, seems so obvious in hindsight.

-

-

In Brief Futureproof

Youth Month, so time for Woolies’ second annual Youth Makers competition. The Group is investing two bar in 15 winners who will receive a one-year mentorship, insider information on how retail works in South Africa, the opportunity to market to Woolworths customers, and a R130,000 grant to grow their brands. The competition is part of The Dapper One’s ‘Inclusive Justice Initiative’ that takes action against discrimination and marginalisation and promotes inclusion and empowerment. Moving on, Massmart, in celebrating World Environment Day, has shared some of its water-saving initiatives, including water generators which extract moisture from the air and convert it to potable water and are deployed to stores in water-poor areas in times of stress; 24/7 water consumption tracking using ultrasonic water meters that detect leaks when they happen; and aircon-condensation capture at 15 Makro stores. On leak-tracking alone Massmart saved around 15 million litres last year. Finally, Food Lover’s Market has announced that it has raised an impressive 5 million meals as part of its annual Hunger Month campaign, exceeding their original target by 1 million meals.

Comment: Meaningful ways of marking these awareness-raising dates on the calendar. The Massmart water-saving initiative is particularly inspiring; waste of any sort is a massive drag on the financial and planetary bottom line.

-

-

International Retailers Avobarcodo?

So it has come to this: to save on plastic waste and cost, Tesco is replacing those tiny barcode stickers it puts on its extra-large avocados with a laser-etched imprint. It’s also trialling replacing plastic tray packaging for two of its most popular avocado lines and moving to a cardboard container. Tesco sells almost 70 million avocados a year with demand growing +15% in the last year. In other news of avocados, the growing industry in Michoacán, Mexico, has fallen into the hands of criminal cartels, which are illegally cutting down indigenous pine forests to grow the water-intensive crop. There’s huge money in this: Michoacán produces 4 out of every five avos eaten in the US, where consumption has doubled even as local production in drought-stricken areas has plummeted. Conflict over control of the industry has become predictably violent, with cartels literally killing each other over resources, and indigenous militias springing up to defend their forests against further destruction.

Comment: Are some things just supposed to be scarce and expensive? Asking for a planet we know.

MANUFACTURERS AND SERVICE PROVIDERS

-

Oceana Plenty of fish in the… oh, wait

A big set of interims from listed seafood outfit Oceana, who saw revenue from continuing operations increase +12% to R5bn for the six months through March, and profit surging +86% to R716m. This, says Oceana, was due in part to “strong pricing across all products, particularly fish oil”. Its US-based Daybrook business delivered record first-half earnings, while its iconic Lucky Star pilchards brand back home also delivered the goods. Notably, posher punters, including those who shop at Woolies, are adopting the once blue-collar protein in their droves. And the cancellation of the Peruvian anchovy season due to El Niño has had the effect of driving up prices globally. The business is pretty sanguine about the rest of the year, too, as the total allowable catch of pilchards in SA was increased by +67% to 65,000 tons for the season. Oceana seems to be investing for growth: CAPEX was up +45% to R297m, including R132m for the upgrade of the West Coast canned foods and fishmeal plants.

Comment: A great South African business, and an iconic brand, outperforming a perennially tough sector.

-

-

In Brief Taking flight

The board of RCL FOODS has approved the separate listing of its poultry unit Rainbow Chicken Limited on the JSE, effective end-June. RCL, you will recall, recently posted a very good set of interims, with revenue up +11% to R7.29bn in the six months through December 2023, and its underlying earnings before interest, taxes, depreciation and amortisation (EBITDA) up +365% to R287m. The separate listing of SA’s largest chicken producer, they say, gives it a route to more sustainable profitability. Moving on, congrats to SAB, which has introduced to a responsibly thirsty market Corona Cero, an alcohol-free beer with Vitamin D, meeting the consumer needs for increased choice and moderation. Why the Vitamin D? “The feeling of the sun is one of the things that people love most about the outdoors, and the Corona brand is always innovating to remind them of that feeling of getting outside,” explains VP for marketing Vaughan Croeser. Congrats also to Distell, whose Savanna Premium Cider has officially been ranked the No.1 cider brand in the world by volume in the IWSR (International Wine and Spirits Research) Global Cider Report.

Comment: Will the spinning off of the chicken wing, as it were, provide more stability for the RCL grocery business? We shall see.

TRADE ENVIRONMENT

-

The Economy Flatlining

Every month, the erstwhile analysts at Trade Intelligence publish what in our humble opinion is the most succinct and illuminating update you’ll find anywhere on the numbers driving South Africa’s economy. Here are some of those figures, direct and uncoated with sugar, as you’d expect. GDP for the first quarter of 2024 was down -0.1% QoQ, largely due to lower output from mining, manufacturing and construction, but offset in part by growth in agriculture, personal and financial services, and trade activity. CPI, up +5.2% year-on-year for April, stayed in the northern limits of the Reserve Bank’s targeted 3-6% band for the 11th consecutive month, but ahead of the ‘mid-point’ so the cautious Bank left the interest rate unchanged. And finally, real retail trade sales were up a surprising +2.3% for March – but with Easter falling into that month this year (it was in April last year) and with declines in both January and February, there is more than a little uncertainty for the April prospects.

Comment: For a still – scandalously – free summary of the full report, click here.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“Business is never so healthy as when, like a chicken, it must do a certain amount of scratching around for what it gets.”

1.png)