THIS ISSUE: 19 Apr - 25 Apr

Big news from Makro this week, and the upcoming re-write of the Checkers Sixty60 app speaks volumes about the relentless perfectionism that has led to the success of the Shoprite business in general. Some interesting news from suppliers, not all of it good, and should you wish to get your customer team up to speed on the numbers they need to negotiate effectively, Trade Intelligence has something for you. Enjoy the read.

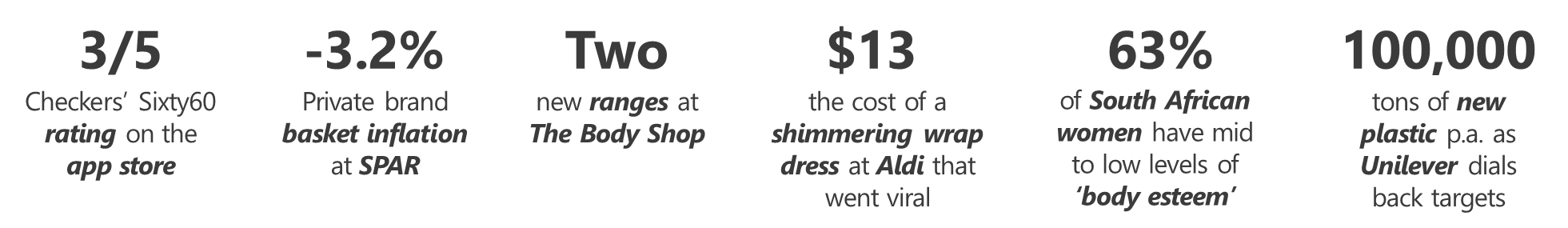

YOUR NUMBERS THIS WEEK

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Makro “I shall call him … mini-Makro”

In one of the best ideas we have ever reported on in these pages, Massmart will soon be testing a mini-Makro format (Mikro?) in four locations in popular malls, on the sites of existing Games stores, although they are not at liberty to disclose where these initial locations might be. “We've chosen Makro to be the leading omnichannel brand for our group, which – in addition to our investment in developing, with Walmart's global expertise, a leading-edge e-commerce platform – also requires significantly expanding our Makro store footprint, thereby improving physical access to our customers,” explains Dries D'Hooghe, the new CEO of Massmart’s wholesale Makro and Cash & Carry businesses. The new stores will commence trading early in the second half of the year. If the concept proves successful, an aggressive rollout may be expected.

Comment: Game, as reported last week, might be one of SA’s top ten most valuable brands, but this value has not translated into footfall or profits of late. Makro, on the other hand, is a highly profitable South African institution.

-

-

Checkers Turns out it is broke…

Not Checkers, obviously, but the Sixty60 app, which according to Shoprite CEO Pieter Engelbrecht is going in for a total rewrite. Given the wild success of the service driven by the App, you might think this is premature. Not so: the Sixty60 app, which receives a 3/5 on the app store, has issues – for example, there’s no way to update delivery instructions after submitting an order, the search function sometimes shows completely different products to the queries, there are frequent out-of-stocks, and the driver tracking feature sometimes doesn’t work. What’s still good? Shoprite responds very quickly to complaints for one. And then there’s the R35 flat delivery fee, with no additional costs. Plus, from a Shoprite perspective, it’s as profitable as all get-out, thanks in no small part to its unique approach to fulfilment. “We have this very large footprint of stores that we use as micro fulfilment centres as opposed to a very expensive single dark distribution centre,” explains Mnr. Engelbrecht.

Comment: The relentless drive to improvement is baked into the Shoprite DNA at this point.

-

-

Private Brands Private investigations

Every year, our friends at BusinessTech run a price comparison of private brands across some of the major retailers, and it’s a pretty solid indicator of where they’re pitching their offerings. They use a basket of ten food and six non-food (think household cleaning) items and look at Woolies, Checkers, SPAR, Pick n Pay, and the Pick n Pay No Name range. Um, Shoprite? Makro? need not apply, apparently. Anyway, Pick n Pay’s No Name range comes in as cheapest, at R665.84 across the basket, with Checkers Housebrand next, SPAR and Pick n Pay’s more upmarket PnP brand pretty much neck and neck, and Woolies a careless R883.84. The average increase across retailers was an inflation-beating +2.6% from 2022’s basket, although Woolies again, +8.7%. In the store sampled, SPAR was actually down -3.2%. This against the backdrop of CPI which was up 0.3 percentage points to 5.6% for February, although food and non-alcoholic beverages inflation was down a touch to 6.1%.

Comment: Private brands are a critical differentiator for increasingly cash-strapped punters and the retailers who serve them.

-

-

In Brief Connect the dots

In this age of nine-year-old TikTok millionaires and teenage Instagram moguls, the thought of any business spending actual money on advertising is almost quaint. That said, news from Woolies this week is that it’s appointed local media agency Connect, an M&C Saatchi Group South Africa company, as its media agency, to conduct the above-the-line media strategy, planning and buying for the Dapper One across all business units, including Fashion, Beauty & Home, and Foods. Connect prides itself on a deep understanding of the ‘attention moment’, where messages are not just seen by consumers but understood. Next up, The Body Shop, in bankruptcy overseas but thriving under the protection of Click on these shores, is launching two limited-edition new ranges: Bluebell, a range of products which will give one (and we use that term advisedly) a dewy-looking skin, and Yuzu, a collection of illuminating and lightweight body care products infused with yuzu extract.

Comment: The last time we had dewy-looking skin was when we woke up face down outside our tent at Splashy that one year.

-

-

International Retailers You had us at “Shimmering Viral $13 Wrap Dress”

Walk with us, if you will, down the Aldi Finds aisle, a linear oasis amid the cans of own-label green beans and affordable yet surprisingly good champagne, where you will find “a rotating assortment of specialty items available for a very limited time.” These items could include a hammock or a furry sweater for your pup, a plastic garden gnome or a patio rug. A lighting fixture, a set of pots, a scented candle, or a pair of off-brand sneakers. Even, if you’re very lucky, a limited-run return of the abovementioned wrap dress. Among fans, who are legion, it’s called the Aisle of Shame, and they report their purchases breathlessly on Facebook. For Aldi in the US, it’s the source of 10% to 15% of annual sales, and a far larger contributor to margin.

Comment: For some of our retailers, general merchandise seems like an afterthought – a thin selection of basic goods in an apparently random grouping of categories. Aldi shows that random need not be the enemy of good, and that a shot of mystique in one small area can drive footfall across the store.

MANUFACTURERS AND SERVICE PROVIDERS

-

Unilever When Dove cries

A juxtaposition of interesting news this week from Unilever. First, Dove has just launched a groundbreaking report called ‘The Real State of Beauty’, in which it reveals, inter alia, that 63% of South African women, and 35% of girls aged 10 to 17, grapple with mid to low levels of ‘body esteem’ and that the levels of confidence South African women once held in their own beauty has dropped from 93% in 2016 to 72% in 2024. “Beauty should be a source of confidence, not anxiety,” correctly notes Dove ambassador Mpoomy Ledwaba. “These statistics are a stark reminder of the work still needed to dismantle unattainable beauty standards and foster a culture of inclusivity and self-acceptance.” Amid this, Dove has undertaken never to use AI to represent real women in its ads, AI augmentation being one surefire way to elevate beauty standards to impossible levels. And then, against an -8% decline in the share price, Unilever has committed itself globally to scaling back its investments in environmental and social initiatives. So, for example, instead of halving its use of virgin plastics by 2025, it will aim for a 33% reduction by 2026 – putting another 100,000 tons of fresh plastics into play every year.

Comment: Perhaps there is a way for businesses to consider the interests of shareholders not yet born.

-

-

In Brief Cereal monogamy

A trading update from Oceana Brands, which has let shareholders know that it expects HEPS to almost double for the interim period through March, after improved canned food sales at Lucky Star and higher fishmeal and fish oil sales at Daybrook. Next, ,strong>Coca-Cola Beverages SA has won its appeal against the Competition Commission at the Constitutional Court, in which the Court found that it was market conditions that caused job losses in 2019, rather than the merger of four independent bottlers from which CCBSA had emerged. Moving on, research by International Baby Food Action Network, has found that two of Nestlé’s best-selling baby food brands sold in Africa and other poorer parts of the world contain high levels of added sugar and honey, but are sugar-free in Switzerland. And finally, congrats to ,strong>Futurelife® for the success of its ASPIRE2B Digital AI Wellness Experience at the Canal Walk store in March. Using AI technology, the free wellness assessment provides customers with personalised insights into their biological age, stress levels, and skin condition.

Comment: From an unexpectedly successful breakfast cereal to an avatar and owner of wellbeing itself, Futurelife is demonstrating what an ambitious investment in brand innovation can unleash.

TRADE ENVIRONMENT

-

Net Revenue Management Casting a wider net

Amid fierce price competition, promotional pressures, and increasing trade discounts, FMCG suppliers are struggling to grow both sales and revenue. One promising route to more profitable trading is net revenue management (NRM). For more on exactly what NRM entails, click here. But to effectively implement NRM, a solid underpinning of both insights and skills is needed – and in South Africa, these skills are often lacking among suppliers’ customer teams. Trade Intelligence is here to help, with products and services that support businesses, including a growing suite of capability-building products. One of these is Trade Maths, which directly addresses gaps in commercial skills among customer teams and empowers them to conduct more effective negotiations with retailers.

Comment: For more information on the very popular Trade Maths workshops and our other capability-building solutions, click here or contact Shelley van Heerden at shelley@tradeintelligence.co.za.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“He who conquers others is strong; He who conquers himself is mighty.”

1.png)