THIS ISSUE: 05 Apr - 11 Apr

Three big stories below about Shoprite, which is not surprising given its emergence as the predominant force in SA FMCG. But rest assured, we’ll be back with the rest of the merry crew next week. Also, all sorts of scrapping and jostling among the manufacturers, and Eskom provides us with an adequate supply of electricity, but charges more exorbitantly for it. Enjoy the read.

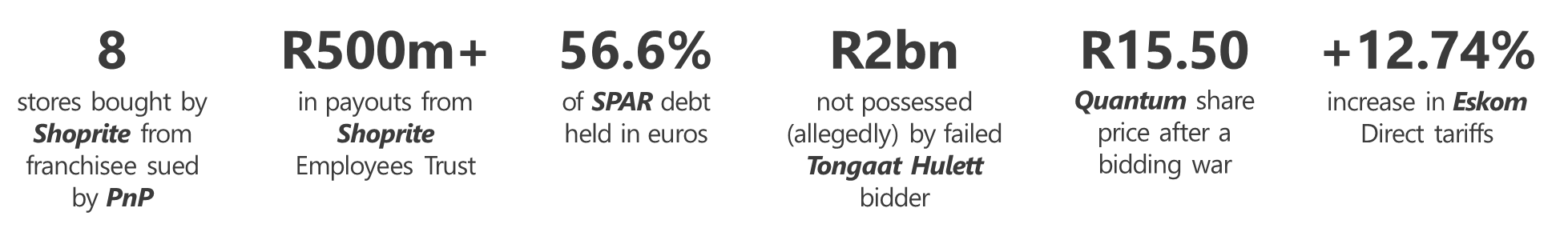

YOUR NUMBERS THIS WEEK

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Shoprite Gapsed!

And the winner of the unseemly fracas between Pick n Pay and East Rand franchisee John A Baladakis turns out to be …. Shoprite! Baladakis, you will remember, was being sued by PnP for R224m in monies owed; for his part, he argued that debt stemmed from changes in the discounting model Pick n Pay introduced in 2018, which favoured sales volumes over margins. Two courts sided with the retailer, then PnP sued for his liquidation to recover the cash – the first time the business had ever acted against a franchisee this way, and a source of discomfort to CEO Sean Summers, who had known the Baladakis family for some time. In this week’s twist, it turns out that Shoprite has leased all eight retail properties owned by Baladakis and is busily converting them to stores – a Shoprite which has already opened in Birchleigh, and seven Checkerses soon to come.

Comment: One of those David vs Goliath stories, where David defeats Goliath armed only with, erm, another Goliath.

-

-

Shoprite Is it a bird, a plane, a …. hedge fund? (spoiler alert: no.)

News straight out of left field this week is that Shoprite has teamed up with four other retailers globally – viz. Ahold Delhaize (US, Europe, Indonesia), Tesco (UK, ROI, Europe), Woolworths Group (Australia, New Zealand), Empire Company Limited/Sobeys Inc. (Canada) – not to form a retail supergroup, like the Travelling Wilbury’s of the grocery industry, as you’d expect, but to establish a venture capital fund. W23, as it’s excitingly if enigmatically called, will invest in innovative start-ups and scale-ups that deploy technology to enhance customer experiences, transform the grocery value chain and address the sector’s sustainability challenges. “At a time when innovation is reshaping retail and value chains across the economy, we aim to offer our investors incomparable access to transformative innovation in grocery and sustainability across the globe,” says CEO and Chief Investment Officer Ingrid Maes.

Comment: : Fascinating. A way of non-competitively sharing the cost of innovation while ensuring ROI by enabling startups to take their products to scale across the retailers involved and elsewhere? Or are we overthinking this?

-

-

In Brief Share and share alike

Two years ago, Shoprite established the Shoprite Employee Trust to recognise the importance of people in its business and reward their engagement and loyalty with a stake in the bottom line. Since then, 122,000 employees have received a share in over R500m in payouts; the fifth distribution of this was recently completed. Initially valued at R8.9bn, the Trust was established on a non-vesting, evergreen basis with 40 million Shoprite Checkers shares. Next up, Woolies has concluded the acquisition of 93.45% of the shares in the posh pet store Absolute Pets from Sanlam Private Equity and Absolute Pets management for an undisclosed fee; it will conclude its buyout of management in due course. Finally – something for the numbers gang to puzzle over: SPAR’s debt burden of R10bn some change is made up almost entirely of foreign credit – 56.6% of it in euros mostly held in Ireland, and 41.8% in Swiss francs.

Comment: Shoprite has established the model for doing the right thing that is also somehow good for business.

-

-

International Retailers Sacre bleu!

Carrefour and PepsiCo have just settled a months-long dispute which saw the latter’s products temporarily delisted from the former’s shelves and casts a light on the shifting dynamic between retailers and suppliers generally. At issue, initially, was the usual: pricing. But some commentators are suggesting that since PepsiCo is not just a supplier to Carrefour but also a client of the retailer’s burgeoning instore-media sales business, this might have lent some strength to PepsiCo’s arm. Margin for advertising is way higher than it is for groceries, after all. The two have settled, no details given, and PepsiCo brands are back on les étagères. Next, across the channel, Morrisons has installed thousands of AI-powered cameras across its stores in to help staff restock faster. The tech is provided by Seattle-based Focal Systems and monitors four on-shelf states: out of stock; planogram non-compliance; low stock; and restocked. And Sainsbury’s is deploying facial-recognition software to reduce shoplifting.

Comment: Truly, we live in an age of wonders. And yet, surprisingly, also still planograms.

MANUFACTURERS AND SERVICE PROVIDERS

-

Liquor Still made from actual grapes, as far as we know

In its headlong rush to penetrate every aspect of all of our lives, AI has made something of a splash in the wine world. With sessions at two prestigious international shows focusing on the technology. At Vinexpo Paris 2024, Thomas Fournier, Chief Digital Officer at Hopscotch Sopexa, shared how AI is transforming the creative domain, offering tools that augment human creativity. And at Germany’s ProWein 2024, Wines of Moldova showcased two novel cuvées, a red and a white, whose production processes – from harvest to vinification, blending, and labelling – were overseen by AI, though the tangible tasks such as fermentation and blending were conducted by human vintners. In other news, Heineken has announced the continuation of its Green Seeds Entrepreneurship Programme, an ongoing Enterprise Development initiative that empowers small businesses by ensuring compliance with relevant legislation, providing access to markets, fostering financial inclusion and addressing the daily challenges encountered by SMEs. Finally, the Beer Association of South Africa (Basa) has appointed Charlene Louw as its new chief executive officer. The association champions the vital – and inarguable – role the beer industry plays in South Africa’s economy, culture and heritage.

Comment: For a deeper dive into the forces shaping the Liquor retail space right now, look out for the Trade Intelligence Liquor Report, out soon.

-

-

In Brief Easy, boys.

A hopelessly complicated bidding war among the directors and shareholders of Quantum Foods has resulted in the share price being driven up from R4.50 to a dizzying and unrealistic R15.50. This as company chair André Hanekom and outgoing CEO Hennie Lourens increase their respective stakes to attempt to retain the independence of the business against a consortium that includes rival Country Bird Holdings, Silverlands of Luxembourg and Braemar Trading, with ties to Zimbabwe. In another wrangle, AVI could be investigated for flouting empowerment rules over the disposal of a R1.2bn equity partnership between its I&J frozen seafood business and Mkhuseli Jack, who wants the BBBEE Commission to declare invalid AVI’s decision to dump his Main Street 198 as an empowerment partner in favour of Twincitiesworld. Next, Vision Investments, buyer of troubled Tongaat Hulett, has opened a fraud case against losing bidder RGS for having submitted a forged bank letter claiming it had R2bn to buy the company, when it didn’t. Finally, our industry’s loss is the Beloved Country’s gain as Tiger Brand’s Thembisile Sehloho assumes the position of Chief Marketing Officer (CMO) at South African Tourism.

Comment: Eish. Perhaps everyone should just take a deep breath.

TRADE ENVIRONMENT

-

Electricity Power games

As a colder wind blows over the vlakte, and people look to their heaters, Eskom has really come to the party by implementing its Eskom Direct tariffs, which increased across the board by a minimum of +12.74% on the first of April, the day on which we celebrate idiocy and cruel humour. The hikes will see direct residential customers paying between R168 and R792 more per month on their electricity bills and will up the total increase for key industrial and urban customers to 13.29%. On the upside, at time of writing, Eskom tell us that load shedding will remain suspended until further notice, after two weeks of no rotational power cuts. This it attributes to sustained available generation capacity, sufficient emergency reserves, and anticipated “moderate demand”.

Comment: Another way of saying that load shedding is an unnecessary waste of an otherwise OK economy.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“Every man is guilty of all the good he did not do.”

1.png)