THIS ISSUE: 08 Mar - 14 Mar

A quiet week in our industry, although Sea Harvest did release its results, painting a complex picture of a challenging industry and a diversified business. Some welcome innovation in the packaging-free space, this time aimed at lower-income shoppers. And some extremely mediocre GDP growth in the fourth quarter of last year. Enjoy the read.

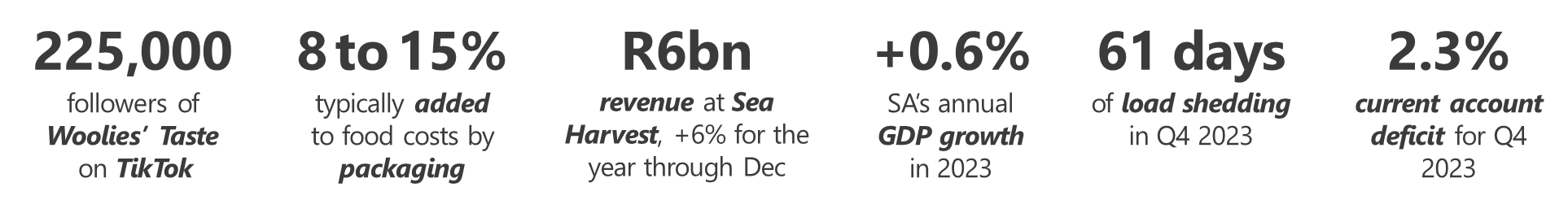

YOUR NUMBERS THIS WEEK

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Woolworths A Taste of things to come

This is some very snappy headline-writing and no mistake: “Iconic Taste brand embraces a digital-first future.” How about: “Taste mag goes kicking and screaming into online-only format”? Whatever the feelings of the actual journalists over at Taste, the brand itself still seems very much a part of the Woolworths communications bundle. After launching on TikTok just a year ago, Taste has over 225,000 followers on the platform, with some videos reaching over five million views. “We were able to maintain and build on Taste’s digital success during lockdown and the audience has told us where they are,” asserts editor-in-chief Kate Wilson. “Now we need to be able to speak to them more often with even more content. That requires a single-minded approach.” Taste magazine was launched in 2003, and its 190th issue due to be published in July/August 2024 will be the brand’s final printed magazine.

Comment: It's not so bad. We at the Tatler have been online for the better part of 20 years, and we still earn our daily crust.

-

-

Gcwalisa Granular detail

As anyone can tell you who has paid for yet another Woolies bag while seven or eight of them languish in the boot of the Volvo SUV in the car park, package-free groceries might not be just around the corner for everyone. If we can’t get reusable bags right, what hope do we have of remembering seven or eight Tupperwares to do the weekly top-up? But there are some businesses still advancing this important and even profitable mission. One is Cape Town’s Nude Foods. Another is Gcwalisa, a container store operating in Joburg, which dispenses branded essentials like Ace mealie meal, Tastic rice, and Golden Cloud flour to shoppers, who take them home in reusable containers or the paper bags provided. The idea, explains founder Miles Khubeka, is to give township residents access to wholesale prices. “Poorly paid consumers bear the brunt of poverty tax, where food and other household items are more expensive when not purchased in bulk,” he says.

Comment: This way, shoppers can buy only what they need, and avoid packaging costs, which typically add 8 to 15% to food costs.

-

-

In Brief Rise of the Machines Part MCXXV

To help address South Africa’s worrying nursing shortage, the Dis-Chem Group is awarding bursaries to 26 full-time students from Nelson Mandela University, Life Healthcare Group, the University of Johannesburg, Tshwane University of Technology, and Witwatersrand University. “By providing assistance to these students, we aim not only to foster their personal and professional growth but also to improve the healthcare workforce and delivery, guaranteeing a brighter and promising future for our healthcare system,” says Dis-Chem clinic executive, Lizeth Kruger. Next up, Shoprite has announced that it has introduced an AI pricing tool, designed with global firm Boston Consulting Group. It looks at several different mathematical arrangements – from product size to the locations where a product is sourced – and makes use of around 12 petabytes of data on the shopping habits of Shoprite’s punters to keep prices down.

Comment: Big data is coming for every aspect of our industry. Hop onboard, as Shoprite is doing, or get left in the dust.

-

-

International Retailers Droning on

Nice work this week from SPAR International, whose partnership with food-waste business ‘Too Good To Go’ has yielded another five million Surprise Bags saved. How it works is: every day, SPAR stores include products approaching their best-before date in Surprise Bags made available through the Too Good To Go app, which shoppers then pick up from stores at a pre-arranged time. The partnership across 13 countries and 2,000 stores has reduced food waste and avoided 12,500 tonnes in CO2e emissions. Next, erm… up, as it were, Walmart now offers deliveries by drone from 31 hubs across six states in the US, where it has completed over 20,000 drone deliveries over the past two years. The Big Feller has been testing this particular route to market with two companies, DroneUp and Wing, and it would be a mistake to see the technology as still in its infancy at this point. Walmart is utilising drone delivery for pretty much anything – 75% of the 120,000 items in the inventory of a typical supercenter may be dispatched this way.

Comment: A time of wonders, that all too soon will seem quotidian.

MANUFACTURERS AND SERVICE PROVIDERS

-

Sea Harvest Plenty more fish in … oh, never mind.

Sea Harvest’s results are in for the year through December, and while revenue was up +6% to R6bn, it wasn’t all plain sailing, with net profit down -8% to R269m on increased finance costs, difficult fishing conditions exacerbated by climate change, and higher fuel prices. Sea Harvest operates 57 fishing vessels in South Africa and international waters, and these use around 30 million litres of fuel a year. Other challenges include the oversupply of prawns, the price of which has fallen by -25% in a year. On the upside, recent fishing rights allocations have given the Group a +5% increase in its allowable hake catch, a 500-ton-a-year abalone (better known to us as perlemoen) business is coming of age and becoming profitable, and sanctions have removed Russian competition from the US and European markets – notably in hake and white fish.

Comment: The ongoing fortunes of businesses like Sea Harvest depend on a healthy ocean ecosystem – something that is increasingly under threat.

-

-

In Brief Crunch time for food safety

A minor shakeup in the sheds as Astral sells its 9.8% interest in Quantum Foods to Country Bird, for a total consideration of R141.7m. Astral had originally purchased the stake to reduce the risk associated with the fact that Quantum supplies it with around 600,000 broilers per week. The risk to the supply agreement has apparently passed, and the arrangement was never meant to be permanent. Moving on, Clover has become the latest business to pull its peanut butter products off the shelves, as a result of higher-than-acceptable levels of aflatoxin that may lead to health complications like nausea, vomiting, and abdominal pain. Clover withdrew over 10,000 units of its 400g Go Nuts peanut butter, following the example of Pick n Pay, Dis-Chem and Woolworths. All had acquired the unsafe product from House of Natural Butters.

Comment: An unfortunate peek under the bonnet of our industry, where competing retailers and brands will often share suppliers – in this instance, with unfortunate results.

TRADE ENVIRONMENT

-

The Economy It moved!

Oh, yay! GDP growth was up +0.1% for the fourth quarter of 2023, a time of year traditionally associated with profligate spending on Black Friday specials, Christmas gifts and festive foods. This sent the haul for the year positively skyrocketing (ok, not really) to +0.6%. “The modest GDP growth is not just a number – it’s a call to action to ensure economic policies and initiatives are inclusive and supportive of all South Africans, especially those vulnerable to financial distress,” says CEO of Debt Rescue Neil Roets. The stark decline in agriculture – which is especially impacted by variables like load shedding – was particularly worrying, he said. On the upside, the Beloved Country experienced ‘only’ 61 days of load shedding for the quarter – a number that when taken in isolation doesn’t seem all that, however when compared with the 91 days in the third quarter is cause for celebration. In the meantime, our current account deficit (the measure by which imports exceed exports) widened dramatically in the fourth quarter to 2.3% of GDP from 0.5% of GDP in the third quarter, which essentially means we’re spending more on goods and services than we are receiving.

Comment: Tough indicators; the social conditions they reflect are tougher.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“Lovers of print are simply confusing the plate for the food.”

1.png)