THIS ISSUE: 01 Mar - 07 Mar

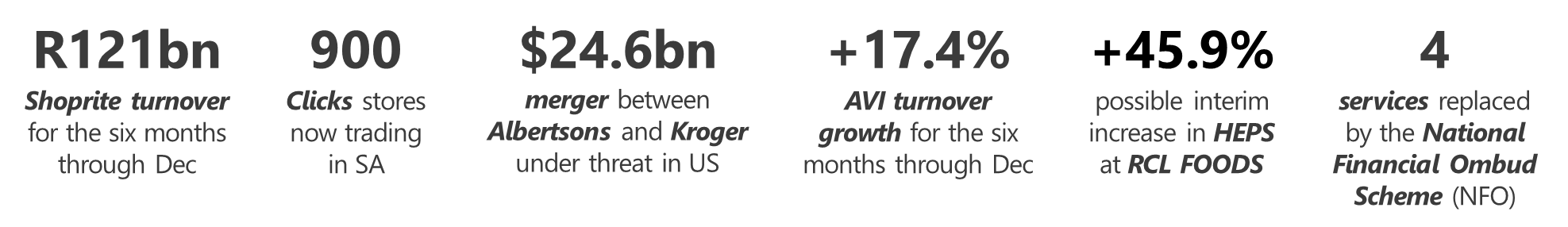

Some stories down below pertaining to the regulation of business by government fiat, the establishment of regulatory bodies, and the investigative efforts of the press. Also, a slew of interim results: RCL FOODS, AVI, and of course Shoprite, running roughshod over the competition now and showing retailers both local and global how it’s done in a tough economy. Enjoy the read.

YOUR NUMBERS THIS WEEK

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Shoprite More than OK

The eagerly awaited Shoprite interims are out this week, and, well, what can we say. Sales up +13.9% to R121bn for the six months through December, 8.3% of this is attributable to new store openings and acquisitions, with like-store sales up a more modest +6.3% in a, shall we say, challenging economy. But hey: trading profit up +10.7% to R6.7bn, with a healthy margin of 5.5%. During the period, the Group added 197 new stores for a total of 3,543, creating 2,617 jobs. And as predicted, Sixty60 continued to whack it out of the park, growing +63.1% and delivering out of a nation-spanning 505 stores. “Whilst the operating context in South Africa remains challenging and costly, especially taking into consideration the ongoing cost of diesel generators during load shedding, we are most pleased to report an increase in profits and dividends for the period,” noted a visibly happy Pieter Engelbrecht, CEO.

Comment: Innovation, yes. Sticking like glue to the basics, certainly. But Shoprite have also achieved a critical mass that in this market is going to be hard to take on. For more on those results, click here.

-

-

SPAR Powerful stuff

News from SPAR this week is that the South African parent company is lending R250m to underperforming member stores in Namibia, including SPARs and Build Its. It’s also offering R114m in loans to mostly corporate-owned shops in SA and R13.5m in security to secure a lease in Poland, where it has a “strategic” retail site even as it seeks to exit the unprofitable eastern European business; to retreat from Poland, SPAR has to repay about R1.3bn in debt held in that unfriendly geography, where it has been unsuccessfully seeking a buyer for its operations. In better SPAR news, the retailer is trialling a fleet of 65 electric delivery vehicles, charged by a combination of grid and solar power, with an annual offset of around 3.27 tons of carbon emissions per bike. The charging cost is relatively hefty, at over R10,960 per day for the fleet, but SPAR is undaunted: “Long-term talks are underway with charging infrastructure providers to allow integration into new and upcoming charging networks,” says omnichannel executive Blake Raubenheimer.

Comment: Tough times for SPAR, but the business is nevertheless seeking to innovate and do the right thing by dear old Mother Earth. Excellent work.

-

-

In Brief Bean there, done that

Congrats this week to Clicks on the opening of its 900th store, in Barlow Park, Sandton. The current footprint now includes 716 pharmacies and 204 clinics. “Our expanded footprint means that 50% of South Africa’s population live within 5.3km of a Clicks pharmacy and therefore able to access affordable healthcare,” says Managing Executive Vikash Singh. Moving on, Pick n Pay has been given the nod by the Jo’burg High Court to attach the property of the Baladakis group, after the franchisee lost its battle to stop liquidation for its R224m debt. “On a personal level, it is deeply disappointing as I have known the family for some 30 years and have not taken this decision without due consideration,” says CEO Sean Summers. “But the truth of the matter is that the serious financial situation that the Baladakis [group] finds itself in is a reality.” Finally, more congratulations, this time to Game which technically became the first retailer to launch a can of KOO baked beans into space, on the 29th of February, by way of a repurposed weather balloon, to launch a one giant leap for essential products promo.

Comment: And one giant win for the ad team that came up with that one. Sometimes the craziest ideas do achieve liftoff.

-

-

International Retailers Cry me a river

Not the feelgood story one would expect, but in the UK, the WWF is accused of shelving a report on harms resulting from the food supply chain that showed Tesco in a poor light. Many of the poultry farms causing pollution in the catchment of the river Wye and documented in the report supply Tesco with product. WWF has received over £6m in donations from Tesco since 2018; while the charity says that the report in question was shelved because it was substandard, insiders differ. Globally, phosphate from poultry manure in catchments causes algae blooms that suffocate fish and plants alike, and damage riverine ecosystems. Over in the US, the proposed merger between grocery giants Albertsons and Kroger has hit a major obstacle in the form of a preliminary injunction filed by the Federal Trade Commission (FTC) which after investigation has concluded that the $24.6bn acquisition by Kroger would eliminate competition between the two, damaging the bargaining power of workers in their efforts to secure stronger contracts with improved wages and benefits. Albertsons argues that the merger would be good for shoppers who would otherwise be left to the anti-competitive depredations of massive outfits like Walmart and Amazon.

Comment: The power of big business, kept in check by investigative reporting and regulation.

MANUFACTURERS AND SERVICE PROVIDERS

-

CHEP A Powerful Combination

The CHEP brand is strongly identified with its iconic and ubiquitous pallets, which are the backbone of supply chains worldwide. CHEP is also increasingly recognised for its affordable, reusable plastic crates (RPCs). But what many customers don’t realise is that in combination, the pallets and crates form an efficient, safe, and affordable solution for transporting goods efficiently and inexpensively across the supply chain – from the farm or factory to the shelf. From agriculture and retail to manufacturing and pharmaceuticals, pallets and reusable plastic crates cater to diverse industry needs with standardised designs and specifications. Whether it’s safeguarding delicate fresh produce during transit or reducing the amount of cardboard waste in landfills, these versatile solutions offer unparalleled reliability and adaptability in any operational setting. RPCs and pallets don’t just provide efficiencies – they offer ease of handling, reduce worker fatigue and potential injuries, provide superior protection against product damage, improve safety, reduce loss from damages, and reduce returns.

Comment: As the leading pallet and RPC provider in sub-Sahara Africa, CHEP enables businesses across the region to achieve operational excellence while reducing their environmental impact.

-

-

AVI Sailing into the wind

Interims from Anglovaal Industries Limited (AVI), a name that rolls off the tongue like an aged brandy enjoyed at leisure in a leather armchair at the Illovo Club. Where were we? Ah, yes. Revenue up +7.1% to R8.38bn for the six months through December, with profit after tax up +17.5% to R1.24bn, and HEPS tracking that at +17.4%. Revenue at I&J was down -5% due to poor catch rates and loss of export sales resulting from port inefficiencies, while Snackworks reported growth in both biscuits and snacks on higher selling prices and improved snack volumes. Indigo’s personal care revenue was down -11.7% after the termination of the Coty distribution agreement last July. Solid stuff, but the business says it could have done better even in the face of constrained consumer demand had it not been for direct load shedding costs of R21.1m and production sites affected by unreliable municipal infrastructure and port inefficiencies disrupting the supply chain.

Comment: Hats off to another great South African business succeeding in the face of ludicrous constraints.

-

-

In Brief Coming home to roost

A quick trading update from RCL FOODS, who reports that HEPS for the six months through December are expected to be up to the tune of +41%-45.9%, due to an improvement in its chicken business and its sugar division that benefited from the rise in global sugar prices. It has also announced that it will be unbundling its underperforming and relentlessly cyclical Rainbow Chicken business, to be separately listed on the JSE. Rainbow did well in the reporting period, on the back of lower maize prizes, which make up around 70% of input costs. Next, according to parent company AB InBev’s results, SAB had a good year, growing revenue in the mid-teens on a mid-single digit increase in volumes. “Beer has remained resilient through consistent and continuous investment in our brands and our market,” noted SAB CEO Richard Rivett-Carnac. Finally, congratulations to Adel van der Merwe, currently the executive in charge of the Quantum Group’s layer farming and eggs businesses, who takes over the reins from outgoing CEO Hennie Lourens as he retires after 28 years in the business.

TRADE ENVIRONMENT

-

Financial Services Banking on it

When we first began our journey with this now-venerable broadsheet, common wisdom held that all retailers were essentially banks, selling stock, sitting on the cash, then paying suppliers months later and profiting however marginally from the interest earned. Now, of course, many retailers are full-blown providers of financial services, from lines of credit to cash savings, to personal, pet, and funeral insurance policies. So it should be of interest to our industry that the banking sector is facing more robust regulation in the form of the newly-established National Financial Ombud Scheme (NFO) a one-stop, all-in-one dispute resolution service made up of the four (4) former existing services – the Ombudsman for Banking Services (OBS); the Credit Ombud (CO); the Ombudsman for Long-Term Insurance (OLTI); and the Ombudsman for Short-Term Insurance (OSTI). “We believe that both the financial customers and the participants of the scheme will benefit significantly as a result of the new single-entry point process, with the same rules applicable to all types of complaints,” says Ombudsman for Banking Services Reana Steyn.

Comment: Onerous perhaps, but a well-regulated sector with solid accountability in place is ultimately good for consumers and service providers alike.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“The key to everything is patience. You get the chicken by hatching the egg, not by smashing it.”

1.png)