THIS ISSUE: 16 Jun - 22 Jun

Some interesting stuff down below about how Whitey Basson headed off the Walmart threat back in the day. We dig deeper into SPAR’s recent results. Adcock Ingram enters a global net of (completely above-board) pharmaceutical intrigue. And retail trade sales, ugh. Enjoy the read.

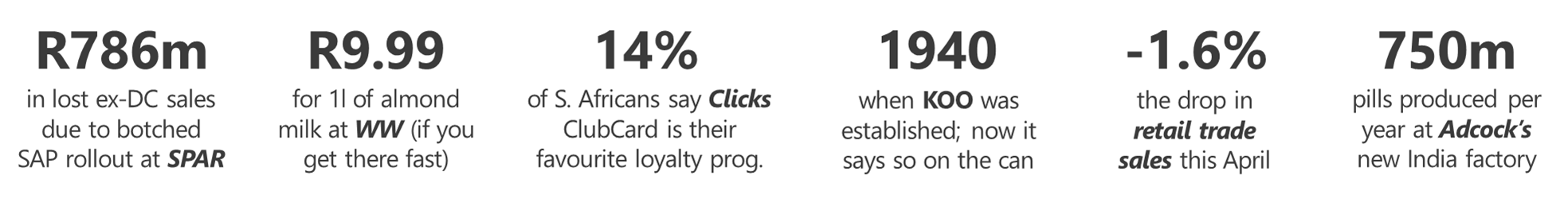

YOUR NUMBERS THIS WEEK

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Massmart Head ‘em off at the gulch

Back when the Trade Tatler was a scurrilous broadsheet, sold on street corners by plucky urchins every Wednesday morning sharp, there was a lot of speculation about which of our big retailers Walmart would be buying. Spoiler alert, it was Massmart, but why? For starters, Makro was probably the retailer that most resembled the Walmart model, so there was that. But according to Whitey Basson, he himself had a more than minor role to play in the decision, pointing to the cultural predilections of Massmart CEO Mark Lamberti, who, he said, was a Walmart man through and through. Basson’s thinking was that a Walmart-owned Pick n Pay would prove too stiff a competitor for Shoprite, which was not then the market-owning behemoth it is now. And having interested Walmart in Massmart, he then nudged the government into approving the deal on the condition that Massmart remain listed, and thus less able to make aggressive business decisions.

Comment: Truly, giants walked among us. Ackerman and Basson. Lamberti himself. Retail is poorer for their exit.

-

-

SPAR SAPped of energy

We reported on the SPAR trading update a couple of weeks back; the Group has since released its full interims, with no additional surprises other than that operating profit declined almost -18% to around R1.5bn for the six months through March, on turnover growth of +7.9% to R72.9bn. A major contributor to the decline was the botched SAP rollout at its KZN DC: KZN was the first of the regions to launch SAP; integration and go-live issues negatively impacted distribution operations there. The resulting reduced service levels to member retailers in the region caused them to look elsewhere for their stock, even as SPAR brought in deliveries from other regions, and this led to lost ex-DC sales of as much as R786m. This in the face of a predicted R1.4bn diesel bill for load shedding over the full year – much of which will not be passed on to the shopper. SPAR is currently seeking a new CEO, with the board acutely conscious that now is not the time to leave the big chair unfilled.

Comment: Although interim guy Mike Bosman is doing a bang-up job in this most tricky ambit.

-

-

In Brief Ug give free rock with every three sharp sticks

As all major retailers extend their vegan and vegetarian products across the food categories, Woolies is bringing almond milk to the planet-conscious punter for half the price of a litre of the real stuff, at R9.99 rather than the usual R29.99, as a result of excess stock that is threatening to expire. Next, big up to Pick n Pay, whose Smart Shopper loyalty programme was ranked number one in the ‘Provides Most Value’ category in a recent survey by impossibly named research outfit TrendER/infoQuest, very narrowly pipping the venerable Clicks ClubCard scheme. However, in the ‘Most Popular’ category among the retailers it was Clicks (14%), Shoprite Xtra Savings (13%) and Pick n Pay (12%). Related, Checkers, which seems to be trialling the Amazon Prime model with the limited launch of a subscription service on its Sixty60 delivery platform, tied in with its Xtra Savings loyalty programme. Those invited to join the Xtra Savings Plus program will pay a “launch offer” monthly fee of R99; those who join later will likely pay R149. The service offers subscribers unlimited free deliveries on Sixty60 orders over R350, plus an additional 10% discount on their first monthly in-store shop.

Comment: There’s life in the old loyalty model yet, it seems.

-

-

International Retailers Facepalm

In the UK, all 237 LloydsPharmacy branches located in Sainsbury’s stores have ceased operation, as part of a restructuring of the Lloyds business, which was acquired by private equity cowboys Aurelius, who doubtless want to squeeze every last drop of value out of the deal. They’ll also be closing some of the standalone Lloyds stores; 2,000 jobs are on the line. At a time when we use our actual faces merely to open our telephones, it seems almost quaint that Whole Foods would be using palm-readers in lieu of credit cards for payment. But so it is. Developed in tandem with Amazon’s even creepier Just Walk Out cashierless checkout system, the reader, which responds to the unique features of the palm of the shopper’s hand, was installed in 65 Whole Foods markets across California last year. A survey conducted by Visa found that around half of small business owners and consumers in eight countries believed contactless payments were one of the most important safety measures a store could provide.

Comment: Now, once we’ve figured out a plan for all the surplus people…

MANUFACTURERS AND SERVICE PROVIDERS

-

Adcock Ingram The mysterious East

An interesting bit of news that somehow never made it onto our radar: Adcock Ingram, SA’s second-largest pharmaceutical manufacturer, has opened its first factory in Bengaluru, India, a three-floor, 7,878sqm plant with an annual production capacity of 750 million tablets, 75 million sachets, and four million bottles. The factory, which it has opened with its Indian partner Medreich Ltd. under the Adcock Ingram Pharma banner, will allow it to expand production capacity for its contract manufacturing organization (CMO) business. This means, as far as we can tell, that Adcock Ingram Pharma will sell meds to Adcock Ingram Holdings back in SA, and to other clients under their own brands. Medreich operates in 55 countries and manufactures medications for GSK, Pfizer, Sanofi Aventis, Novartis, Mylan, Apotex, and of course Adcock Ingram, inter alia. It is itself part of the Meiji Group, a leading Japanese conglomerate with interests across the globe in pharmaceuticals, food and nutrition products.

Comment: A rabbit hole of ownerships, partnership, joint ventures and licensing agreements in this most ingewikkeld of industries.

-

-

In Brief Something of a Koo for the agency

Bit of a brand refresh for the iconic Koo line of tinned goods over at Tiger Brands. Nothing too alarming, they’ve added a little “Est. 1940” heritage bit to their classic gold oval, and a pleasing swoosh treatment to the photographic window on the can that highlights its contents. Updated the descriptor typeface, dropped the serifs. Plus, the Value-Add, Premium and Fruit ranges are colour coded. “We have proactively refreshed our iconic and well-loved KOO brand positioning, balancing its heritage with evolving consumer needs, while remaining true to the Tiger Brands purpose to nourish and nurture more lives every day,” says Zayd Abrahams, Chief Marketing and Strategy Officer, explaining the thinking. Next up, sponsorships: Mondelez-owned Cadbury has partnered with SA Rugby as the Official Confectionery Supplier to the Springboks. “This collaboration represents a powerful union of two iconic brands that share a common goal of uplifting spirits and fostering a sense of togetherness,” says SA Rugby CEO Riaan Oberholzer. And beloved brekkie cereal Futurelife® has become the official nutrition partner at the highly anticipated Siphiwe Tshabalala Foundation Soccer Tournament in Phiri, Soweto, this July.

Comment: Sports, South Africans, beloved brands. Match made in heaven.

TRADE ENVIRONMENT

-

Retail Trade Sales Declining fortunes

Last week we casually dropped the news that retail trade sales were down -1.6% for the month of April. Chief contributors to the decline were general dealers – the category under which supermarkets fall – which fell -2.8% and contributed -1.2 percentage points; retailers in food, beverages and tobacco in specialised stores (-6.2% and contributing -0.5 of a percentage point); and all ‘other’ retailers (-4.2% and contributing -0.5 of a percentage point). The very slightly better news is that sales were +0.4% up for the month compared with March, but again, down -1.3% for the quarter. And they’ve declined now for five straight months YoY, putting us within a month of a retail recession. “The electricity supply predicament continues to weigh heavily on costs, reducing profitability, while consumers remain financially constrained dealing with high inflation and interest rates,” says Investec economist Lara Hodes. “In the short-term, we don’t anticipate a meaningful pick-up in household consumption expenditure, which makes up around two-thirds of GDP.”

Comment: A worry that supermarkets are now contributing to the overall decline.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“I come from a food family, so you would think that I would be great at making baked beans or something, but I'm not.”

1.png)