THIS ISSUE: 26 May - 01 Jun

Last week, we mistakenly referred to Powerade as an energy drink; it is in fact a sports drink, and one that has fuelled generations of South African athletes at that. Apologies. This week loads of interims from the manufacturers, a nostalgic trip down Whitey Boulevard, and some well-considered words of warning from CGCSA. Enjoy the read.

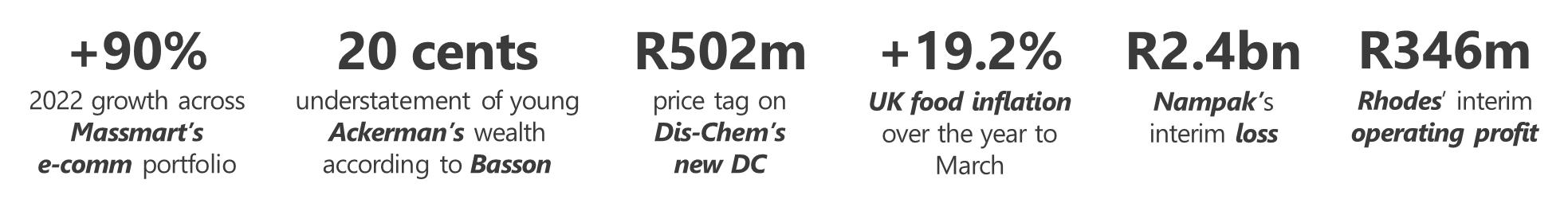

YOUR NUMBERS THIS WEEK

YOUR NUMBERS THIS WEEK

RETAILERS AND WHOLESALERS

-

Massmart Omni-potent

Massmart was an early adopter of the omnichannel approach to retailing, at least on these shores, and has been assiduous in the investments and appointments necessary to make it happen. Witness, last month, the introduction of Walmart’s Global Integrated Fulfilment (GIF) software to all Makro stores, with plans to expand into Game and Builders. Developed for Walmart and adapted for Massmart, GIF Store Assist is an order fulfilment software application that digitises and optimises the picking, packing, staging and distribution of online orders. “We have made significant investments to build and grow our e-commerce offering at Massmart,” says VP of Group eCommerce Pickup & Delivery, Merlin Otto. “Given growth in 2022 of over 90% across the e-commerce portfolio, our ability to efficiently process higher volumes of orders is a key success factor.” Order pick rates have increased up to +150% since implementation, with an overall -40% reduction in total order processing time.

Comment: Massmart’s strategic and methodical embrace of omnichannel has been one of the bright spots of its recent history.

-

-

Shoprite The Wit and Wisdom of Whitey

James Wellwood “Whitey” Basson no longer speaks for Shoprite, more’s the pity. We miss his pith and his wit at the results presentations. But here, from a recent interview, and reviving a once-popular Tatler feature, some pearls of his inimitable wisdom:

On the current management of Shoprite: “They’re fantastic guys.”

On the biggest threat to Shoprite: “The boards in South Africa, the non-executive boards, really are not related to their business... and that can be the downfall of Shoprite over a period of time.”

On how to get by in retail: “It involves a hell of a lot of humdrum work, long hours of hard work... actually every day you lose a bit of your brainpower, so you have to pump it up with reading.”

On his old nemesis: “Raymond (Ackerman) was a wealthy guy. That story that he started with 20c in his pocket is not factually correct. He didn’t tell you what he had in the boot of his car.”

On his old business partner: “Christo (Wiese) is an ordinary bloke. Sometimes he’s quite common. He comes from Upington.”Comment: The philosopher king of our sector, his spark undimmed by retirement.

-

-

In Brief Lean times

As World Hunger Day is marked this week, Woolworths has announced a three-year partnership with six community-based NGOs that play a vital role in supporting access to food and empowering local agri-entrepreneurs, particularly in rural areas. The organisations – ForAfrika, INMED South Africa, Siyazisiza Trust, Social Change Assistance Trust, Thanda, and Timbali Technology Incubator – will focus on providing access to nutritious food in mainly rural areas, promoting and teaching sustainable food gardening and farming practices to improve access to food and support early childhood centres, as well as empowering individuals, especially the youth and small-holder farmers, to become self-sufficient and increase their harvest, markets and income. Next up, more on Dis-Chem’s new warehouse: the R502m, 63,000m2 Gauteng facility will be financed substantially through a loan from Standard Bank and will service increased demand from both Dis-Chem stores and the independent market.

Comment: And there you have it, slow news week.

-

-

International Retailers Nice factory ya got heah…

In the US, Walmart is politely leaning on suppliers which, it believes, have been prioritising price over sales volumes and thus putting the squeeze on shoppers. “Working with those suppliers that are on the prepared foods and consumable categories to get costs down more as fast as we possibly can would help them drive unit volume,” rumbles the big guy ominously. The lifting of COVID restrictions and the raising of interest rates by the Federal Reserve have not worked to reduce inflation as much as you’d expect, suggesting that profit-taking among the FMCG giants might be at play. Over in the UK, prices of food and non-alcoholic beverages rose 19.2% in the year to March, but over there, experts are more inclined to blame poor harvests, climate change, the war in Ukraine, Brexit, the weak pound, and the historically low base off which food prices are rebounding.

Comment: Profit taking under the mask of inflation is a tale as old as time. Well done the Fed for calling it out.

MANUFACTURERS AND SERVICE PROVIDERS

-

Nampak Pak up your troubles

Packaging giant Nampak is in a spot of hot water if its interims are to be believed. While revenue was up +4% to R8.4bn, the business took a R2.4bn loss in the six months through March, as net debt rose +23% to almost R6bn – 10 times its market value. This on foreign exchange losses of R531m in Nigeria and R40m in Angola, and despite good sales in its BevCan division both here at home and in Angola. What is to be done? There is a turnaround strategy, which will involve the merging of the BevCan and DivFood entities, a rights issue of R1bn to offset the debt and massive job cuts, salary freezes and a reduction in overtime. It will also be selling its Tanzanian manufacturing business for $5.5m. Not coincidentally, new interim CEO Phil “The Knife” Roux is known as something of a turnaround fundi, with a wealth of industry experience at businesses like Tiger Brands.

Comment: A lot rides on the success of this strategy – not least the ability of such businesses as Rhodes, SAB, Oceana Brands and Heineken to bring their brands to market in Nampak packaging.

-

-

In Brief The half-time score

A flurry of interims for you this week. First up, Premier Fishing and Brands, with a R34m rise in revenue to R258m, for the six months through March, and profit after tax up +25% to R12.5m, on the back of high catches of lobster and strong demand for squid. Good prospects for next year too as it looks to more than double its volumes of farmed abalone. Next, SA’s biggest egg producer Quantum Foods reported a R78.5m loss for the same period, R40m of that in load shedding costs, with profits down -82% on the back of price increases of +7.5%. But the business is more sanguine about its prospects, believing as it does that input costs have peaked. Finally, the Rhodes Food Group had a stormer of a half as predicted, with operating profit up +43.2% to R346m on revenue growth of +10.2% to R3.8bn, with price inflation up +14.8% as volumes came under pressure in some categories.

Comment: Tough times, tougher businesses. Now if only they could catch up a break from Eskom, we’d see some proper fireworks.

TRADE ENVIRONMENT

-

Food Security Food for thought

The Consumer Goods Council of South Africa (CGCSA) is concerned that the government is not taking its very real fears about food security seriously enough. “We believe we are the most important sector in South Africa because we are feeding the country, but this is not how the government sees us,” says CGCSA CEO Zinhle Tyikwe. Instead of assisting the industry, she says, government keeps piling retailers with unnecessary regulation, thus contributing to rising food costs. “They see the resilience of the retailers and assume that in spite of the load shedding it’s going to be business as usual. And so, they keep putting additional input costs on food that retailers have to deal with from a regulatory perspective.” And as the country faces a long winter with no reliable power, her warnings are becoming more alarming. “We want to put in business continuity plans, we’re starting to plan for stage 8 and even for a possible grid failure,” she says. “We need to know how it's going to affect us, our security, our payments, the availability of food.”

Comment: CGCSA is not known for hair-on-fire alarmism. When it starts talking about grid failure and food-related unrest, government should be listening.

Sign up to receive the latest SA and international FMCG news weekly.

Tatler Archive

Next Event

19 September: Corporate Retail Comparative Performance H2

“I remind myself every morning: Nothing I say this day will teach me anything. So if I'm going to learn, I must do it by listening.”

1.png)